Payment Chart For Fingerhut

Payment Chart For Fingerhut - Information about payment types can be found by clicking the help icon (?). Tax information select the appropriate payment type and reason for your payment. Will paying by card or digital. You can modify or cancel your payment until 11:45 p.m. Find details on payment plan types: Most taxpayers qualify for an irs payment plan (or installment agreement) and can use the online payment agreement (opa) to set it up to pay off an outstanding balance. Use this secure service to create an irs online account where you can view the amount you owe, your payment plan details, payment history, and any scheduled or pending. The irs uses third party payment processors for payments by debit and credit card. Your information is used solely to process your payment. System availability direct pay is available: Most taxpayers qualify for an irs payment plan (or installment agreement) and can use the online payment agreement (opa) to set it up to pay off an outstanding balance. Information about payment types can be found by clicking the help icon (?). Review the amount you owe, balance for each tax year, payment history, tax records and more. If you are making more than. Monday to saturday, 12:00 a.m. If you have made a payment through direct pay you can use this feature to view your payment details and status. Will paying by card or digital. Tax information select the appropriate payment type and reason for your payment. Use this secure service to create an irs online account where you can view the amount you owe, your payment plan details, payment history, and any scheduled or pending. The irs uses third party payment processors for payments by debit and credit card. Use this secure service to create an irs online account where you can view the amount you owe, your payment plan details, payment history, and any scheduled or pending. The irs uses third party payment processors for payments by debit and credit card. Monday to saturday, 12:00 a.m. Most taxpayers qualify for an irs payment plan (or installment agreement) and. Information about payment types can be found by clicking the help icon (?). Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. Find details on payment plan types: If you are making more than. Paying your taxes by check or money order? Sign in or create an online account. Information about payment types can be found by clicking the help icon (?). Your information is used solely to process your payment. You can modify or cancel your payment until 11:45 p.m. System availability direct pay is available: Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. The irs uses third party payment processors for payments by debit and credit card. Sign in or create an online account. Will paying by card or digital. Information about payment types can be found by. Most taxpayers qualify for an irs payment plan (or installment agreement) and can use the online payment agreement (opa) to set it up to pay off an outstanding balance. Sign in or create an online account. Information about payment types can be found by clicking the help icon (?). You can modify or cancel your payment until 11:45 p.m. Review. Find details on payment plan types: If you have made a payment through direct pay you can use this feature to view your payment details and status. Monday to saturday, 12:00 a.m. Look up a personal tax payment view payment history and balance in your online account. Review the amount you owe, balance for each tax year, payment history, tax. Review the amount you owe, balance for each tax year, payment history, tax records and more. Sign in or create an online account. You can modify or cancel your payment until 11:45 p.m. Find details on payment plan types: If you are making more than. Review the amount you owe, balance for each tax year, payment history, tax records and more. Find details on payment plan types: Use this secure service to create an irs online account where you can view the amount you owe, your payment plan details, payment history, and any scheduled or pending. Learn how to make a tax payment and the. Most taxpayers qualify for an irs payment plan (or installment agreement) and can use the online payment agreement (opa) to set it up to pay off an outstanding balance. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. Find details on payment plan types:. Most taxpayers qualify for an irs payment plan (or installment agreement) and can use the online payment agreement (opa) to set it up to pay off an outstanding balance. The irs uses third party payment processors for payments by debit and credit card. System availability direct pay is available: Use this secure service to create an irs online account where. If you are making more than. System availability direct pay is available: Review the amount you owe, balance for each tax year, payment history, tax records and more. Find out how to mail your payment to the irs. The irs uses third party payment processors for payments by debit and credit card. Paying your taxes by check or money order? Information about payment types can be found by clicking the help icon (?). Look up a personal tax payment view payment history and balance in your online account. Will paying by card or digital. Sign in or create an online account. Use this secure service to create an irs online account where you can view the amount you owe, your payment plan details, payment history, and any scheduled or pending. Learn how to make a tax payment and the details of several options you may qualify for if you can't pay in full right now. Monday to saturday, 12:00 a.m. You can modify or cancel your payment until 11:45 p.m. Your information is used solely to process your payment.Fingerhut

Fingerhut

a smart shopping tool you can use Fingerhut Blog

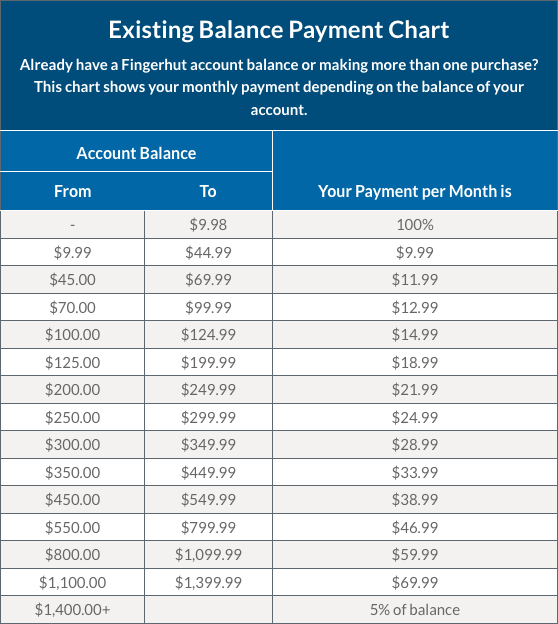

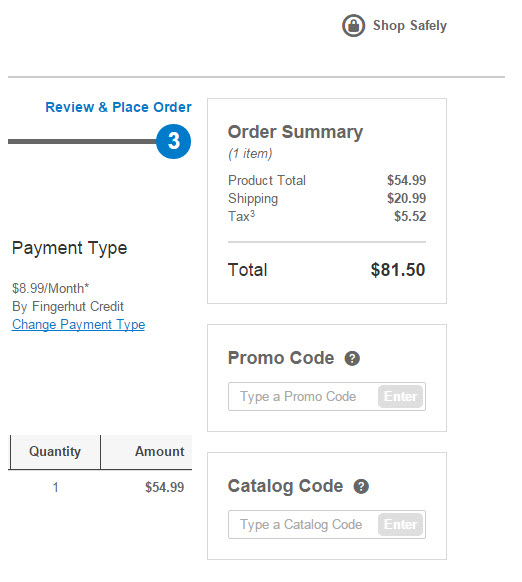

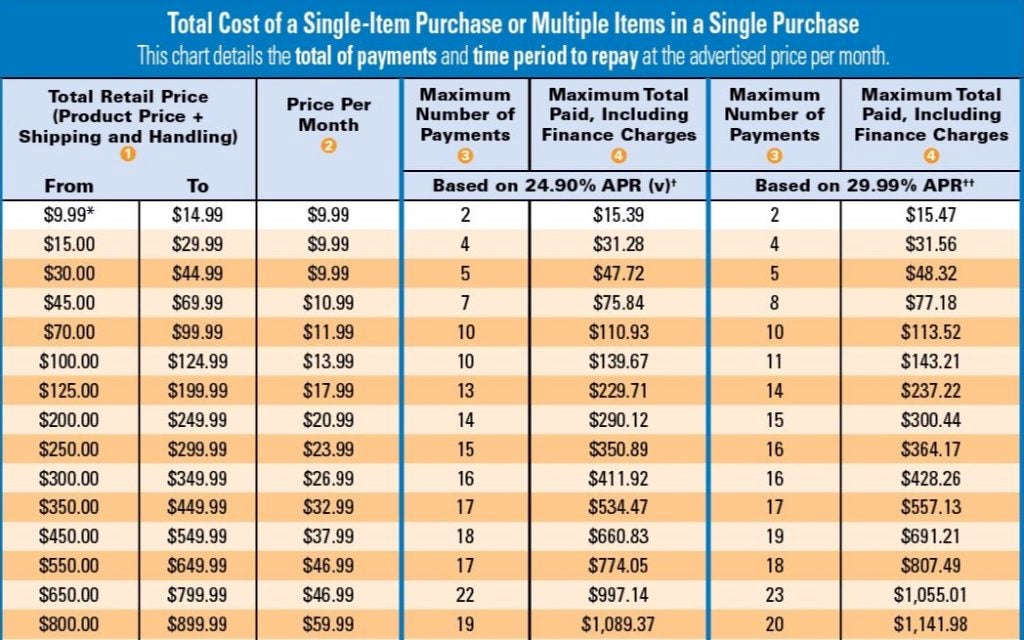

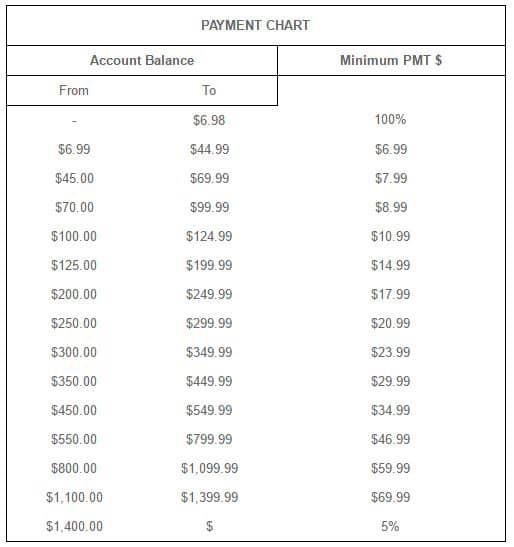

Fingerhut Minimum Payment Chart A Visual Reference of Charts Chart Master

Fingerhut

Guide to Fingerhut Shop your way to better credit

pre approved catalogs like fingerhut

Fingerhut Payment Login

Fingerhut

Fingerhut

If You Have Made A Payment Through Direct Pay You Can Use This Feature To View Your Payment Details And Status.

Most Taxpayers Qualify For An Irs Payment Plan (Or Installment Agreement) And Can Use The Online Payment Agreement (Opa) To Set It Up To Pay Off An Outstanding Balance.

Find Details On Payment Plan Types:

Tax Information Select The Appropriate Payment Type And Reason For Your Payment.

Related Post: