Calstrs Retirement Chart

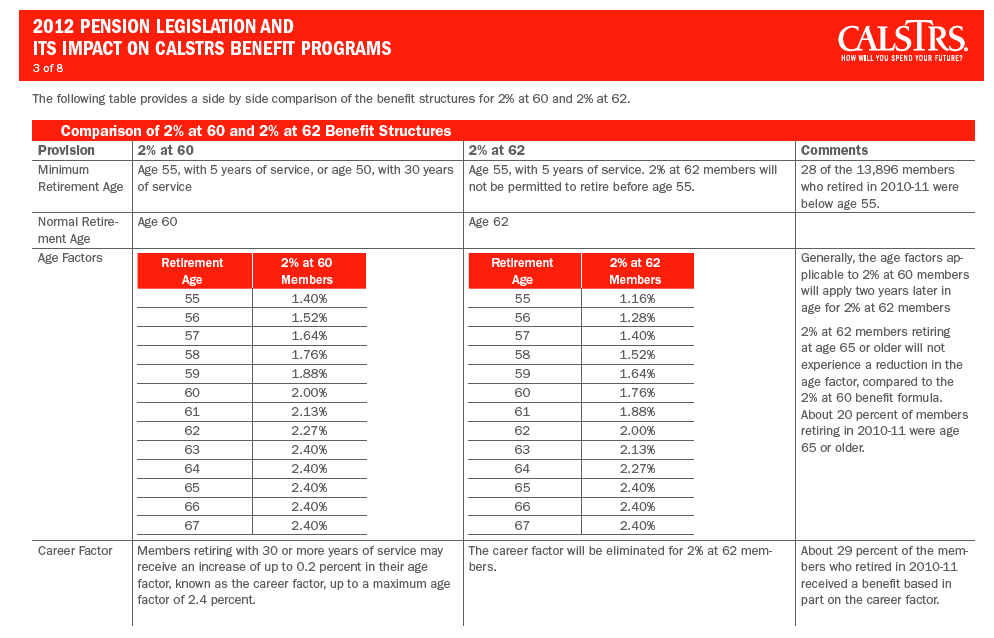

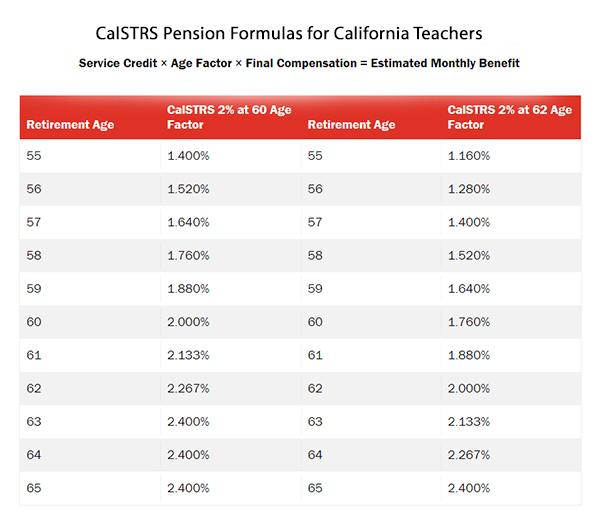

Calstrs Retirement Chart - Are you under the calstrs 2% at 60 benefit structure? Calculate an estimate for each annuity type based on various account. You can use the calstrs calculator to estimate your future retirement benefits based on your current salary and years of service. By inputting your data, you gain insights into how much. Use this calculator to estimate the cost to purchase permissive service credit. Each pdf includes two charts. Decreased if you retire before age 62. To see your benefit factor for each quarter year of age, choose your retirement formula below. The first chart shows how the benefit factor. Increased to a maximum of 2.4% if you retire at age. Learn more about the annuities available to you with the defined benefit supplement annuity estimate tables. Increased to a maximum of 2.4% if you retire at age. By inputting your data, you gain insights into how much. Calculate an estimate for each annuity type based on various account. For members under the calstrs 2% at 62 benefit structure, your age factor is: Each pdf includes two charts. This tool was created to help california educators. Decreased if you retire before age 62. You can use the calstrs calculator to estimate your future retirement benefits based on your current salary and years of service. Use these calculators to help estimate your future savings and expenses, or estimate your benefits through calstrs or calpers. Increased to a maximum of 2.4% if you retire at age. Set at 2% at age 62. Learn more about the annuities available to you with the defined benefit supplement annuity estimate tables. Use these calculators to help estimate your future savings and expenses, or estimate your benefits through calstrs or calpers. For members under the calstrs 2% at 62. Increased to a maximum of 2.4% if you retire at age. Your calstrs retirement benefit will replace, on average, about 54% of your current salary. This tool was created to help california educators. Use these calculators to help estimate your future savings and expenses, or estimate your benefits through calstrs or calpers. Set at 2% at age 62. This tool was created to help california educators. You can use the calstrs calculator to estimate your future retirement benefits based on your current salary and years of service. Use these calculators to help estimate your future savings and expenses, or estimate your benefits through calstrs or calpers. Your calstrs retirement benefit will replace, on average, about 54% of your. By inputting your data, you gain insights into how much. For members under the calstrs 2% at 62 benefit structure, your age factor is: The first chart shows how the benefit factor. Are you under the calstrs 2% at 60 benefit structure? You can use the calstrs calculator to estimate your future retirement benefits based on your current salary and. The first chart shows how the benefit factor. Your calstrs retirement benefit will replace, on average, about 54% of your current salary. Increased to a maximum of 2.4% if you retire at age. Are you under the calstrs 2% at 60 benefit structure? Decreased if you retire before age 62. Use these calculators to help estimate your future savings and expenses, or estimate your benefits through calstrs or calpers. Each pdf includes two charts. Use this calculator to estimate the cost to purchase permissive service credit. Calculate an estimate for each annuity type based on various account. You can use the calstrs calculator to estimate your future retirement benefits based. Decreased if you retire before age 62. You can use the calstrs calculator to estimate your future retirement benefits based on your current salary and years of service. Watch a video and learn how to generate an estimate of your calstrs monthly retirement benefit online. Your calstrs retirement benefit will replace, on average, about 54% of your current salary. Increased. Use this calculator to estimate the cost to purchase permissive service credit. For members under the calstrs 2% at 62 benefit structure, your age factor is: Learn more about the annuities available to you with the defined benefit supplement annuity estimate tables. Watch a video and learn how to generate an estimate of your calstrs monthly retirement benefit online. Decreased. This tool was created to help california educators. Set at 2% at age 62. You can use the calstrs calculator to estimate your future retirement benefits based on your current salary and years of service. By inputting your data, you gain insights into how much. For members under the calstrs 2% at 62 benefit structure, your age factor is: This tool was created to help california educators. Calculate an estimate for each annuity type based on various account. Learn more about the annuities available to you with the defined benefit supplement annuity estimate tables. To see your benefit factor for each quarter year of age, choose your retirement formula below. Set at 2% at age 62. Set at 2% at age 62. Use these calculators to help estimate your future savings and expenses, or estimate your benefits through calstrs or calpers. Learn more about the annuities available to you with the defined benefit supplement annuity estimate tables. Calculate an estimate for each annuity type based on various account. Use this calculator to estimate the cost to purchase permissive service credit. Your calstrs retirement benefit will replace, on average, about 54% of your current salary. For members under the calstrs 2% at 62 benefit structure, your age factor is: Are you under the calstrs 2% at 60 benefit structure? Decreased if you retire before age 62. To see your benefit factor for each quarter year of age, choose your retirement formula below. This tool was created to help california educators. The first chart shows how the benefit factor. Watch a video and learn how to generate an estimate of your calstrs monthly retirement benefit online.CalPERS Retirement Calculator Estimate Your Retirement

EXCEL of Retirement Calculator for HR.xlsx WPS Free Templates

Reform by the ounce, unfunded pension debt by the pound EdSource

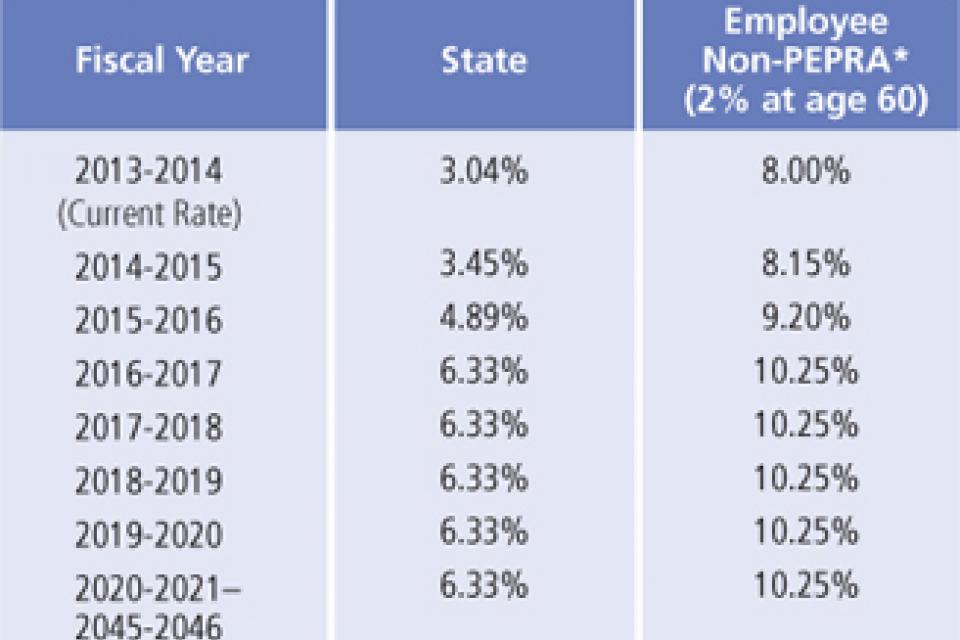

More Info. on STRS Rates The AFT Guild

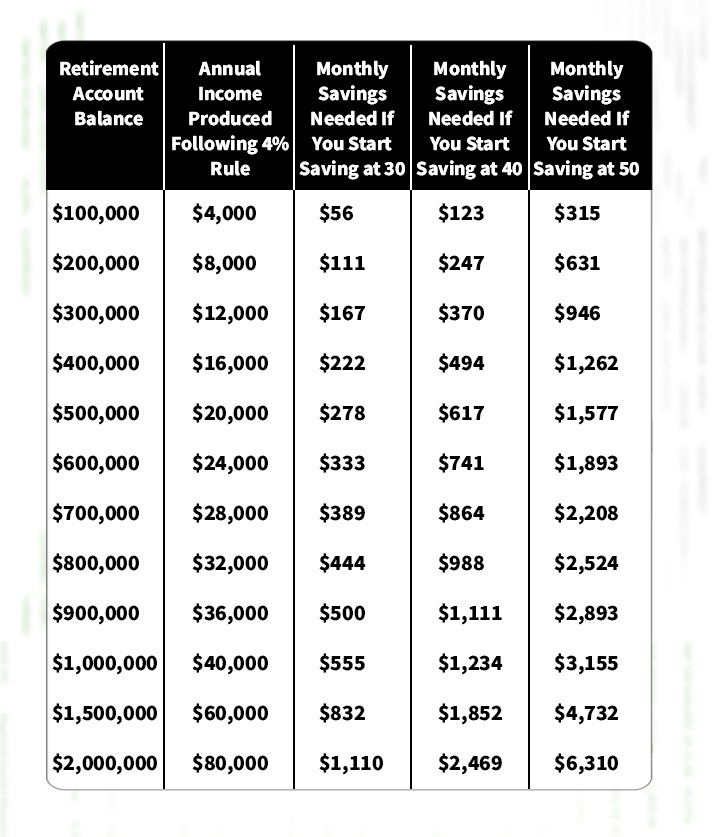

Retirement calculator How much you need to save

Calstrs Pay Dates Fill Online, Printable, Fillable, Blank pdfFiller

Topic Retirement Security CFT A Union of Educators and Classified Professionals

A Pension for the California Teachers Association California Policy Center

Big Bonuses at CalSTRS and CalPERS?

Big Bonuses at CalSTRS and CalPERS?

Increased To A Maximum Of 2.4% If You Retire At Age.

You Can Use The Calstrs Calculator To Estimate Your Future Retirement Benefits Based On Your Current Salary And Years Of Service.

Each Pdf Includes Two Charts.

By Inputting Your Data, You Gain Insights Into How Much.

Related Post: